Insurance companies play a pivotal role in determining the scope of healthcare coverage, including which medications are covered under their plans.

These companies function by pooling risks across a large number of policyholders, allowing them to offer coverage for a variety of healthcare needs.

However, due to financial constraints and the need to balance risks, insurance companies are often selective about the medications they cover.

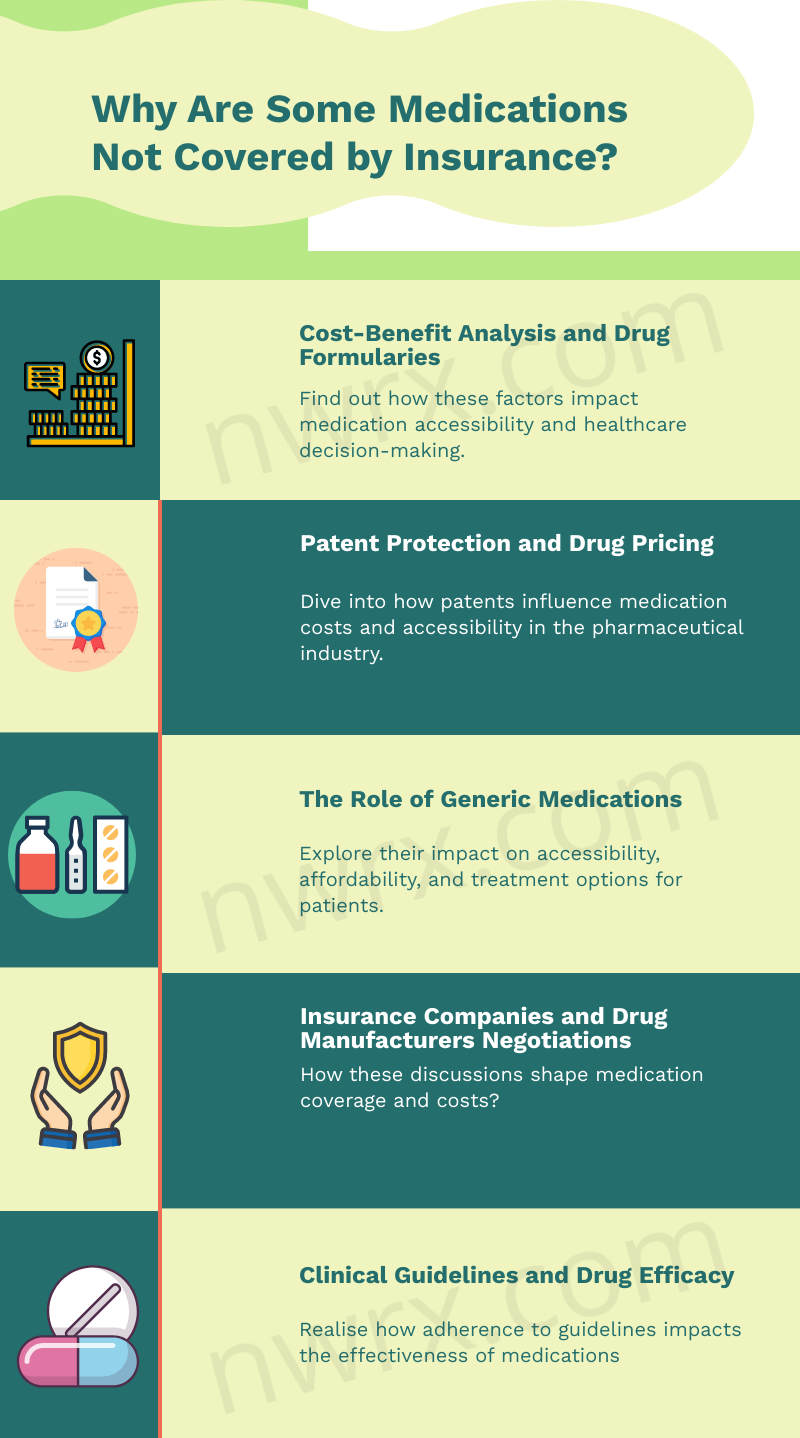

Cost-benefit Analysis and Drug Formularies

One of the primary reasons certain medications are not covered by insurance is the cost-benefit analysis conducted by coverage providers. This process involves evaluating the cost of a medication against its perceived benefit to patients.

Drugs that are deemed too expensive relative to their therapeutic benefits may not be included in these plans. Insurance companies maintain a list of covered medications, known as a formulary, which is frequently updated to reflect these cost-benefit assessments.

Formularies are categorized into tiers, with different levels of coverage and co-payments, influencing which medications are more accessible to patients.

Patent Protection and Drug Pricing

Patent protection is another critical factor influencing medication coverage. Newly developed drugs are often patented, granting the manufacturer exclusive rights to market the drug for a specific period.

This exclusivity allows pharmaceutical companies to set higher prices, which can make it challenging for companies to justify including these drugs in their formularies.

Consequently, some newer, patent-protected medications may not be covered, particularly if there are more affordable, generic alternatives available.

The Role of Generic Medications

Generic medications play a significant role in insurance coverage decisions. These drugs are essentially copies of brand-name drugs that have the same active ingredients, dosage, safety, strength, route of administration, quality, performance, and intended use.

Once the patent on a brand-name drug expires, other manufacturers can produce and sell generic versions, typically at a lower cost. Companies are more likely to cover generic medications due to their affordability, often excluding the more expensive brand-name counterparts from their formularies.

Insurance Companies and Drug Manufacturers Negotiations

Negotiations between insurance companies and pharmaceutical manufacturers are a crucial aspect of determining which medications are covered. Insurance providers often negotiate prices with manufacturers to obtain drugs at lower costs.

The outcome of these negotiations can impact whether a drug is included in the formulary. Drugs that are essential but come with a high price tag may still be covered if the company successfully negotiates a substantial discount.

Clinical Guidelines and Drug Efficacy

Clinical guidelines and drug efficacy also influence insurance coverage decisions. Companies rely on evidence-based clinical guidelines to determine the therapeutic value and effectiveness of medications.

Drugs that are not supported by strong clinical evidence, or those considered less effective compared to alternatives, may not be covered. Insurance providers prioritize medications that have proven efficacy and are recommended by clinical guidelines, ensuring that patients receive cost-effective and clinically beneficial treatments.

Final Thoughts

In summary, the coverage of medications by insurance is influenced by a complex interplay of factors. Cost considerations, patent laws, the availability of generic drugs, negotiations between insurers and manufacturers, and adherence to clinical guidelines all contribute to the decision-making process.

These elements reflect the challenging balance insurance companies must strike between financial viability and providing effective healthcare coverage.

I’m Alastair Watt, a pharmacist with decades of experience in the industry. Recently, I’ve decided to pursue my writing passion, and it resulted in my content at nowrx.com and collaboration with many other websites.